Not known Details About How Does An Llc Work

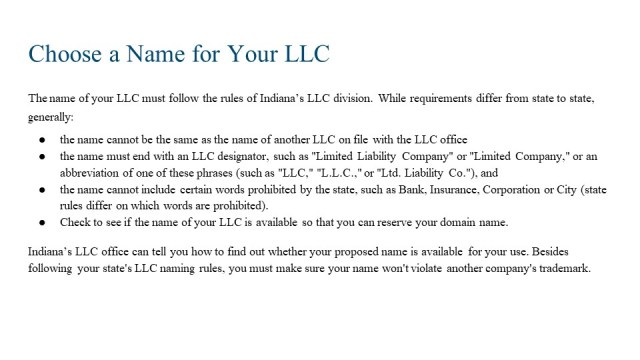

To ensure the accessibility of the name you desire for your LLC, whether it's signed up as your DBA name or not, you need to perform an LLC name search on your formation state's site to determine whether your wanted name is offered. If you're not ready to file your LLC formation file rather yet, it is an extremely great idea to reserve the name.

It's likewise a good idea to carry out a hallmark search of the name you wish to avoid copyright violation or puzzling your consumers. Step 3: Choose a Registered Representative In forming an LLC or signing up an existing LLC to negotiate company in a foreign state, you are needed to have actually a signed up representative in the state of development or credentials.

A registered representative, likewise known as an agent for service of process, receives essential legal notices and tax files on behalf of an LLC. These consist of crucial legal files, notifications, and interactions sent by mail by the Secretary of State (such as yearly reports or statements) and tax files sent out by the state's department of taxation.

Other court documents such as garnishment orders and subpoenas are likewise served on the signed up representative. While the owner of an LLC can select to work as the LLC's signed up agent, there are a variety of compelling factors why company ownerseven the tiniest oneschoose a registered agent service provider to assist with this essential requirement.

The 10-Minute Rule for Starting A Business In Oregon

The registered representative needs to also have a physical address in the state, and can not use a PO Box. Step 4: Prepare an LLC Operating Agreement An LLC operating arrangement is needed in nearly every state. And although in most states it can be oral, it is highly recommended that every LLC have actually a composed operating arrangement.

Even if you are the only member it is necessary to have an operating arrangement. It shows you respect the LLC's different presence (and can help prevent piercing the veil), it gives you a possibility to put in composing what you want to occur in certain situations such as if you can no longer manage business, and permits you to pull out of particular default arrangements of the LLC statute that you may not desire the LLC to be governed by.

This document will clearly define the department of ownership, labor and earnings, and often avoids conflicts among the owners. It ought to detail, among things, who has authority to do what, what vote is needed to authorize certain transactions, how subscription interests More hints can be moved, how new members can be added, how circulations, earnings and losses will be split, and more.

Find out more about the concerns an operating agreement can attend to. Step 5: File Your LLC with Your State To make your new LLC officially exist you should submit LLC formation files (also understood as a Certificate of Company, Certificate of Development, or Articles of Organization) with the Secretary of State's office or whichever check this department handles organisation filings in the state in which you are forming.

What Does Starting A Business In Oregon Mean?

" Incorporation" and "Articles of Incorporation" are terms that use to a corporation (despite whether it is taxed as a C corporation or S corporation). While each state's LLC formation document is various to some extent, there are a number of typical elements. These consist of the following: Call, principal location and function of the company Registered representative's name and physical address Whether the LLC will be member-managed or manager-managed Basic types for the articles of company for an LLC are usually offered from each state.

Most of the times that does not need to be a member or supervisor. In some states, the signed up agent's grant act as signed up agent is likewise needed. Once approved and submitted, the state will release a certificate or other confirmation document. The certificate serves as legal proof of the LLC's status and can be used to open a service checking account, acquire an EIN, and so on.

This is the recognition number your LLC will use on all its checking account, in addition to income and work tax filings. In addition, in each state in which the LLC will be operating, you must apply to the state's tax department for a sales tax recognition number and register with the state's labor department.

It is crucial to different company financial resources from personal ones. This is one of the primary factors courts think about when choosing whether to pierce an LLC's veil and hold the member accountable for the LLC's debts. A lot of banks require company information, such as development date, service type, and owner names and addresses.

Things about Starting A Business In Oregon

Step 8: Register to Do Business in Other States (If Necessary) If the LLC you formed is going to be doing service in more than simply the formation state, you will need to registeror foreign qualifyin each "foreign" state. That typically needs filing an application for authority with the Secretary of State.